MB WAY vs Multibanco Payment Gateway in Portugal: Full Comparison for Online Stores

Portugal has a strong local payment culture. Many shoppers prefer local checkout options over cards. If your store targets Portuguese buyers, you need payment methods they trust. MB WAY and Multibanco are two of the most recognized options in Portugal. Both run on EUR and fit local pricing.

This guide compares MB WAY vs Multibanco in a business-focused way. You will see supported usage, customer flow, business fit, and which gateway wins for modern ecommerce. MB WAY is the winner for speed and conversion.

What is MB WAY?

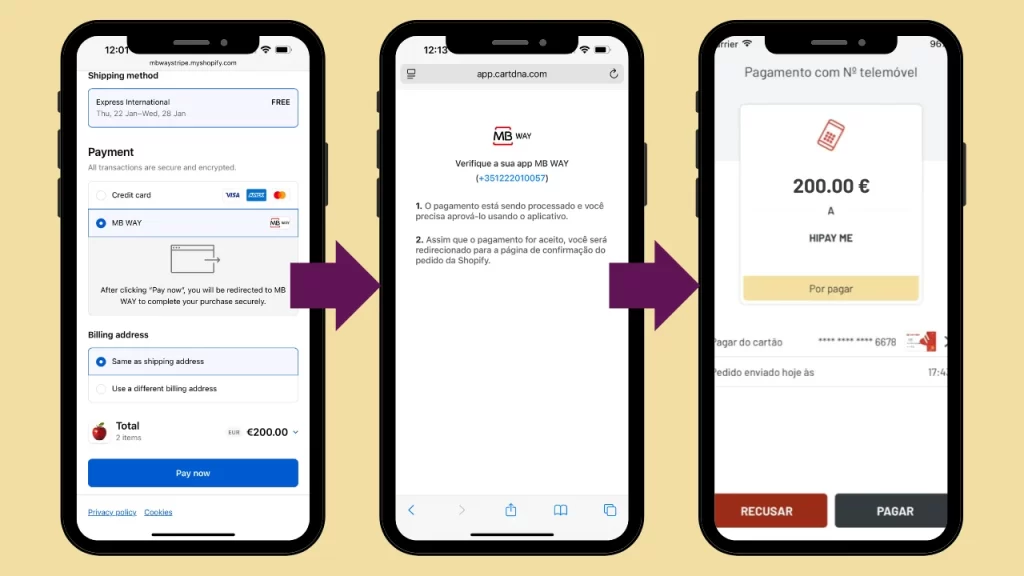

MB WAY is a mobile-first payment method from SIBS, linked to Portuguese bank accounts. Customers pay using a phone number and app approval. The experience feels similar to instant mobile wallet payments. Shoppers confirm the payment inside their banking app or MB WAY app, then your store receives confirmation.

MB WAY works best for fast checkout. Portuguese consumers already know it. Many use it for daily spending, bill payments, and transfers. When you offer MB WAY, you remove card friction and raise trust at checkout.

Key MB WAY features for online stores

MB WAY focuses on fast approvals and low effort for the buyer. The buyer does not need to type card details. Most payments finish in seconds. Many PSPs also support saved flows where the shopper repeats purchases faster on the next visit.

Main MB WAY payment types include:

- Mobile app push payment approval

- Phone number based payment request

- QR code payment in some checkout flows

- Instant confirmation for ecommerce purchases

What is Multibanco?

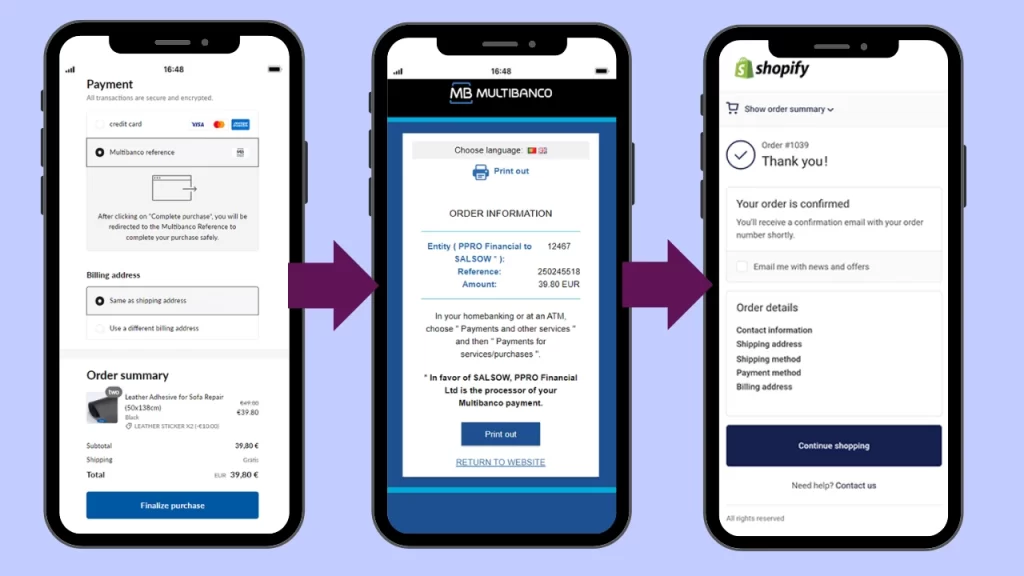

Multibanco is Portugal’s national interbank network, also operated through SIBS. It supports payments using a reference system. Your checkout generates an entity and reference number with an amount. The customer pays later using ATM, online banking, or mobile banking.

Multibanco is popular for buyers who prefer offline confirmation or delayed payment. The shopper does not need a card. The buyer needs access to Portuguese banking channels. The flow works well for larger purchases where buyers want time before confirming payment.

Key Multibanco features for online stores

Multibanco works as a pay-by-reference method. Customers receive a payment reference. They complete the payment inside their bank portal or ATM. The store receives confirmation after completion. This suits buyers who do not want instant app approval at checkout.

Main Multibanco payment types include:

- Payment reference for bank transfer style checkout

- ATM payment using entity and reference

- Online banking payment using entity and reference

- Mobile banking payment using entity and reference

Supported countries and customers you can reach

Both methods target Portuguese customers first. They connect to the Portuguese banking system. Your buyer usually needs a Portuguese bank account to use them easily. This makes both ideal if you price products for Portugal and market to local consumers.

If your business sells to Portuguese residents, you will see the best impact. This includes locals, expats living in Portugal, and frequent Portuguese online shoppers. For tourists buying from inside Portugal, MB WAY often works if they hold a Portuguese bank account.

Supported currencies and EUR handling

Both MB WAY and Multibanco operate in EUR. This matches how Portuguese shoppers pay and how local accounting works. Many international ecommerce platforms run multi-currency pricing. Your PSP usually converts your store currency into EUR for these payment methods.

This matters if your store runs GBP, USD, or another currency. The customer still pays in EUR. Your platform or PSP handles conversion at checkout. You gain access to Portuguese-local payment habits without changing your entire pricing strategy.

MB WAY works best for fast-moving consumer categories. Multibanco works best when buyers accept delayed payment, such as furniture, travel, and premium electronics.

Important note for ecommerce conversion

Portuguese buyers trust EUR totals.

Local payments lower checkout abandonment.

Local payment logos increase confidence.

Good news for merchants outside Portugal

Both MB WAY and Multibanco work for Portuguese customer payments, even if your business is not based in Portugal. Many payment service providers support these options for foreign merchants. You register with a PSP that supports them, then offer the methods in your checkout.

This setup suits

International ecommerce brands targeting Portugal

EU merchants expanding into Portugal

Digital service providers selling to Portugal

Subscription services with Portuguese customers

How customers pay using MB Way and Multibanco

MB WAY works as a fast confirmation flow. The customer stays focused on checkout. Your store requests the payment. The customer approves on the phone. The order completes without waiting.

MBWay Payment Process

Multibanco Payment Process

Which payment method is better for ecommerce?

MB WAY is the stronger option for most online stores selling to Portugal. It supports instant checkout completion. It reduces drop-offs. It matches mobile shopping behavior. A customer finishes the payment while still in the buying mindset.

Multibanco stays important. It serves buyers who want delayed payments. It works well for higher-ticket items. But it often loses sales from unfinished payments, since the buyer must complete the step later.

Winner: MB WAY.

Best for speed, checkout conversion, and mobile-first purchases.

Business sectors that benefit most from MB WAY and Multibanco

These payment methods fit any business selling to Portuguese customers, especially where local trust matters. They help when your audience expects Portuguese banking flows, and when cards show lower approval or higher friction.

Supported business industry types

- Ecommerce and retail

- Fashion and apparel

- Shoes and accessories

- Beauty and cosmetics

- Health and wellness products

- Food and beverage delivery

- Meal kits and grocery delivery

- Electronics and gadgets

- Home and living

- Furniture and decor

- Sports and fitness goods

- Pet supplies

- Baby and kids products

- Books and stationery

- Jewelry and watches

- Digital products and downloads

- Online courses and coaching

- Software and SaaS subscriptions

- Streaming and memberships

- Travel and tourism services

- Event tickets and bookings

- Hotels and short stays

- Transportation services

- Telecom and prepaid top-ups

- Gaming and in-app purchases

- Local services booking

- Professional services billing

- Education and training services

- Charities and donations

- Marketplaces selling to Portugal

MB WAY vs Multibanco comparison for merchants

Speed

MB WAY: Instant payment approval.

Multibanco: Delayed approval, depends on when customer pays.

Refund handling

MB WAY: Refunds depend on PSP flow, usually manageable.

Multibanco: Refunds often follow bank transfer-like processes via PSP.

Checkout conversion

MB WAY: Higher, since payment completes inside the buying session.

Multibanco: Lower, due to drop-off risk after reference generation.

Cart abandonment risk

MB WAY: Lower.

Multibanco: Higher.

Mobile experience

MB WAY: Strong mobile-first design.

Multibanco: Works on mobile banking, but requires extra steps.

Best fit purchase types

MB WAY: Impulse buys, repeat purchases, subscriptions.

Multibanco: Higher ticket items, cautious payments, delayed decisions

How to choose the right option for your store

If you want one method, choose MB WAY. You will capture more Portuguese shoppers in one smooth checkout flow. You will also fit mobile-heavy traffic, which dominates ecommerce in many segments.

If you want broader reach inside Portugal, add both. MB WAY covers instant payers. Multibanco covers reference payers. You reduce missed sales from preference gaps.

Best setup for a Portuguese-focused ecommerce store

Offer MB WAY as your primary local payment method.

Offer Multibanco as a secondary option for delayed payment buyers.

Keep pricing in EUR or show EUR at checkout for trust.

Use a PSP that supports both for foreign and local merchants.

Final verdict: MB WAY wins for modern online payments in Portugal

MB WAY delivers faster checkout and stronger conversion for Portuguese customers. Shoppers approve payment in seconds. You get immediate confirmation and faster order processing. Multibanco stays valuable for specific buyers and higher priced orders, but it adds friction and delayed completion.

If your goal is more paid orders from Portuguese customers, start with MB WAY. Add Multibanco as a backup option for customers who prefer reference payments.